The recent tax reform proposal, introduced yesterday, has both some pretty big winners and losers.

In the first place, the bill, Tax Cuts and Jobs Act, is 429 pages and surprisingly lean. Of course, this kicks off the negotiations with both sides of the aisle and special interest groups.

Who loses more under the Tax Cuts and Jobs Act? Charitable sectors, real estate, big W2 earners, pharma/tech industries, and anyone with college loans.

Who wins? Businesses and individuals.

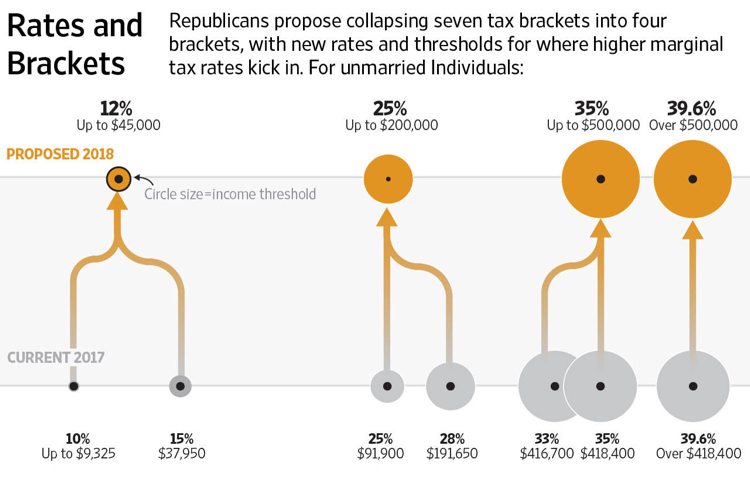

Businesses get a 20% tax rate and pass-through businesses get a 25% tax rate. Families get increased deductions, cutting Alternative Minimum Tax, simpler tax brackets, and $10 million estate tax exemption.

With this in mind, the Tax Foundation prepared a before/after comparison for individuals.

A few more details about the tax reform bill:

1. Pass-Through Business Income

Pass-through business income would have a maximum tax rate of 25%.

Today, most businesses create themselves as a partnership, LLC, and/or S-Corp. Business owners' tax rates are taxed on their individual tax returns and not on the business income.

The proposed law stops this. For this reason, the tax bill implements anti-abuse rates affecting health, law, financial, and other professional services. Notwithstanding, they have that to prove income equals business income.

2. Itemized Deductions

Many itemized deductions would be cut. The mortgage interest, charitable deductions, and property tax portion of state/local tax deduction (capped at $10,000) would remain.

In addition, cutting other deductions (moving, some medical) pays for the lower tax rates.

3. Home Mortgage Loans

People with home mortgage loans over $500,000 do not get to deduct the mortgage interest. Today's number equals $1 million.

Conversely, the bill cuts the mortgage interest deduction for second homes.

4. Estate Tax Exemption

Surprisingly, the tax reform bill increases the estate tax exemption to $10 million. Of course, the estate tax exemption indexed for inflation. After six years, the estate tax goes away.The Tax Cut and Jobs Act has something for everyone to hate and enjoy. Let the tax battle begin.

South Dakota: The Trust Tax Haven

Regardless of where you fall in tax brackets, South Dakota offers a haven for trusts.

There's no income tax or state capital gains tax for assets held in a trust, making it the #1 best state to have a trust.

That's why Wealth Advisors Trust is located in South Dakota.

But there's more to why South Dakota is so important to trusts.

To learn for yourself, read more about why South Dakota is such an incredible place to start your trust.