In this blog post, I will walk you through the process step by step through picking a trustee with a few little surprises so you can choose the right one.

Picking a trustee gets less attention than choosing your new smartphone. In the first place, it is not a fun process.

You and/or maybe your spouse are sitting with your estate planning lawyer. You are planning what happens when you pass away.

For engineers and math people, this is a logical process. For everyone else, it is a winding road of emotions and what-ifs.

To sum up, you have to pick a few positions in your will or separate trusts. In your will, you need to pick an executor, guardian (if you have kids), beneficiary and trustee.

If you have a revocable or irrevocable trust, you will need to pick a trustee and beneficiary.

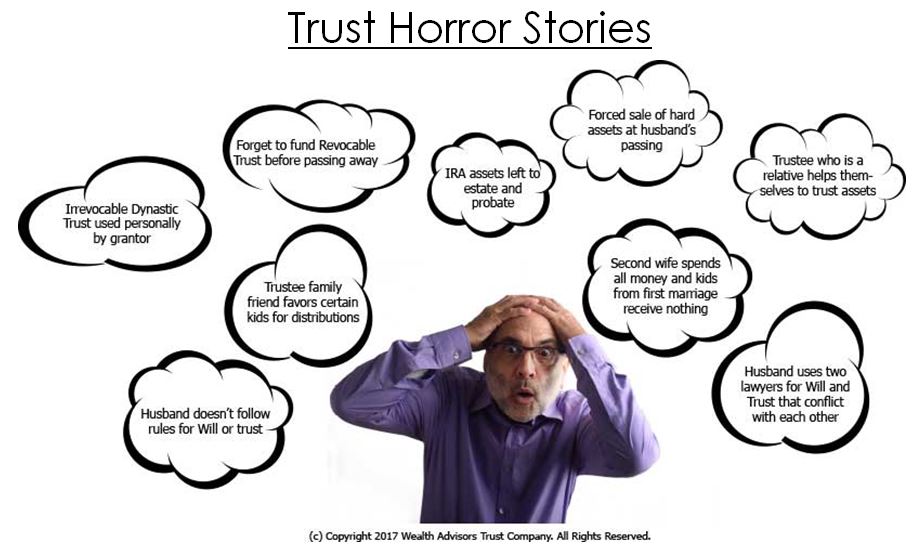

You will feel there are nothing but bad choices when picking a trustee — typically a friend, family and/or corporate trustee. Thinking of your will and last testament probably creates the same feeling — a long list of pros and cons.

Reading the definitive guide on picking a trustee gives you the information and knowledge to make the wisest choice. You'll learn the concepts of trust advisors and trust protectors to place you in the best position possible.

Primarily, this guide will not provide clear all encompassing "yes" or "no" decision steps. It will narrow down the beginner mistakes, give you insight to how all this came to be, and help you make informed decisions.

In short, picking a trustee is really important for one big reason — they control everything.

Download the PDF Version of This Post

Choosing Trustees - Nothing but "Bad Choices"

A trustee follows the rules of the trust document. The trust document creation occurs in your will when you pass away and/or in a separate trust document while you are alive.

In any event, picking a trustee is a must. This remains a very personal decision. After all, the dilemma of picking a trust advisor and trust protector adds to the complication.

Your financial team including your estate planning attorney's and your financial advisor / wealth manager / financial planner can help with this decision.

To clarify, the pros and cons of this selection depends on the assets currently and prospectively held in the trust. Basically, a trustee has important powers like:

- How much and when people get money from the trust

- Permitted investments in the trust

- Protect trust assets from bad people

- Other complex trust accounting and administration rules

Your financial team has many parts to it. Most importantly, the critical point requires them all to communicate in a collaborative and consistent manner. The trust fund industry has many nuisances.

Choosing a trustee offers various forms of bad choices. Although, if you select a friend or family as the trustee they could steal the money, favor one heir over another, offer bad investment guidance, pass away, or ignore details that eventually lead to greater problems down the road.

Adding the roles of a trust advisor or trust protector can reduce those bad outcomes.

If you select a bank trust company as the trustee, they could give horrible service to your heirs, nickel-and-dime the trust with fees, or offer bad investment guidance.

As if that weren't enough, you also need to choose the best state for trusts.

Lawyers' education in law school partially rests on using logic and words to achieve and outcome. As the person making trustee choices for today or tomorrow, you can leverage the same platform lawyers were educated upon.

"We are drowning in information but starved for knowledge"

John Naisbitt

Firstly, understand the pros and cons to every trustee choice. If you don't know them yet, you will at the end of this blog.

Secondly, understand that too much control from the grave yields future disasters.

Thirdly, understand that your heirs didn't earn this wealth, you did, so don't feel guilty if your choices do not seem perfect. Getting close to these points will allow you control and choice using trusts and trustees on your terms.

So why do we need trusts and trustees in the first place?

The History of Trusts and Trustees

The "ownership" of the assets in trust and "use" of those assets makes selecting a trustee a huge deal. The definition of these legal concepts sound boring — until things go wrong.

Moreover, it has taken around 2,000 years to make these concepts so boring that you would never think about their importance.1

The concept of appointing a trustee and the beneficiary's power to remove and to appoint a trustee are still not clearly laid out in modern trust documents. The roles of a trust advisor and trust protector can reduce some complications that result from this vague direction. The challenge of defining these benign concepts began when the rule of law became standard in modern society.2

Any modern society allows for its citizens to own and to transfer that ownership in life and in death. For this to happen freely, a "strict hierarchical structure of the family"3 must exist for the wealthy to retain control of their assets and use it for power.

In fact, during Roman times, a family's wealth came from involvement with the government. The passing of this wealth occurred in testaments — or what we know as wills today.

As the Roman Empire expanded into Britain and subsequently left (around 407AD) the influence of the Christian church, Canon Law, remained.

The bottom line of this mess of the Roman law of wills and Canon Law created the evolution of the concept of a "trustee"4 and trusts (i.e. fideicommissum).

From Bracton's Note Book of court cases and onwards, the responsibilities and duties of a trustee around 'ownership' and 'use' began to take shape under its current form that exists in America.

However, if you want to make sure you pick the right trustee then knowing how this all came about will make that decision more natural and easy.

The Story of a Roman

Below is a historical fiction story of an actual person and real events from the Roman Empire to explain how testamentary trusts truly worked under extreme political and societal stresses. Below are the journal entries.

Journal Entry January 193 AD: My name is Quintis Amelius Laetus. Killing Emperor Commodus might not have been my best decision. He was a nut job though. Commodus made me his Prefect of the Praetorian Guard. My duty to keep him safe from harms way since May 177 AD5 became a reflexive and natural action. Carried out with strict precision and swift execution it came with rewards. The things I heard Commodus say and the actions that followed makes me even now shudder. Commodus was all about Commodus. He shared the wealth he stole, made, etc amongst his best followers. I fell under that banner. As a result, the wealth I was given was at levels beyond my imagination.

I do remember my benefactor, my savior, Marcus Aemilius Lepidus, telling me about the power of creating a testamentary document, a fideicommissum, to transfer my wealth per my wishes via a trust. I am feeling that my time of service and my time on this earth nears its end.

Journal Entry March 193 AD: I learnt a few things from Commodus. I organized the killing of Emperor Pertinax after only 87 days on the throne. I am nervous who will be the next emperor and perhaps auctioning it off will give me protection. Gathering the other Praetorian Guards we met with the fat, vain and wealthy senator Diduis Julianus selling him the emperor throne position. He gobbled it up. The Senate approved it under my Praetorian Guardian forceful suggestion. My time is short. The leading 5 Roman Empire generals do not agree with what just happened especially since we killed Emperor Pertinax. The risk I am considering that might be insurmountable is the strongest general Septimius Severus taking revenge against me. As a result, we are in a civil war between those 5 generals.

Journal Entry April 193 AD: I am working on finalizing my fideicommissum, a trust created at my death through my Will, now that Marcia is pregnant and the civil war wages on. Septimius Severus appears to be the winner, and being a rule follower, I am not sure where I stand should he win and become emperor of Rome. I cannot marry Marcia, but the ability to transfer my wealth and take care of my unborn child, which she carries, can be carried out.

Marcus Aemilius, part of that powerful patrician ruling class, gave me access to the best legal advice. I know that since the decree from the Senatus Consultum Trebellianum in 56 AD, the fideicommissum "removed the fear of lawsuits or under pretext of fear"6 that upon my death my wealth and my heirs, Marcia, would be protected by law. Crazy how the rule law can help or hurt depending on your level of respect. In summary, let's hope the rule law stays consistent in Rome.

Journal Entry June 194 AD: My beloved Quintis Laetus was executed 12 months ago to appease Emperor Severus. Quintis' actions of killing Commodus and the auctioning off of the throne to Julianus was novel but extreme. Our son, Septimius Ameilius Laetus, grows stronger every day with the comfort and protection of the testamentary trust created by his father via his Will.

The Story of a 13th Century British Aristocrat

Below is a historical fiction story of an actual person and real events from a 13th Century British aristocrat to explain how revocable trusts evolved and allowed Crusaders, Aristocrats and laypeople to control their assets during their lifetime and after. Below are the journal entries.

Journal Entry April 1236: Mother and father have been dead for close to 12 months. My sadness felt does not become soothed with the wealth from Mother's family of land around Basingstoke. My extended family of the Heriards, Olivers and Fitz-aces with clergy and jurist connections to the crowns of King Richard and John7 merely increases my gateway to power. This weighs heavily on the mind.

The casualness of our times seem fraught with an underlying intensity pushing all of us forward with uncertainty. At the present time, the Barons, after the initial signing of the Magna Carta some 21 years ago, continue their battle with the Crown. The fighting rages on. We at least are no longer ruled by the principles of force and will. Our private assets are now protected with an evolving discussion of the law. The testamentary trust created under my parents Will came at the right time. Henceforth, I am determined to do something great for our society with my position.

Journal Entry June 1238: I have decided to do good with my inheritance. Mother provided well for those in need. Our house, included in my inheritance, should be placed for true charitable use and ownership for a new hospital in Basingstoke. These shall ease the discord amoungst the laypeople. My studies within the law and the church do not provide time to participate in the hospital but my cousin, Peter Fitz-aces, has decided to provide additional monies for the hospital itself. I ponder the avenues of the testamentary trust legal construct around the 'use' and 'ownership' of a living trust during my lifetime.

Journal Entry August 1238: I accepted participation of the clergy and the law. The festivities controlled themselves in light of warring actions on the Continent and closer to home. Apart from my jurist duties negotiating all sorts of unmentionables8 for Nick Farnharm, Bishop of Durham, I came across the philosophical writings of Ibn Rushd, Abu'l Walid Muhammad. They were most disturbing but intriguing. King Richard's entourage, from this Third Crusade quest, brought back many journals and writings. Ibn Rushd posits that under Islamic law, the believer can create a charitable trust (i.e. waqf khayri) or a family trust (i.e. waqf dhurri). All things considered the outstanding question centers on the selection of the trustee.

Bishop of Durham was distraught that under Islamic Law a beneficiary of a trust can enjoy those fruits right away. New ideas appear fraught with skepticism. Under those circumstances how shall the selection of a trustee be explained? The Bishop mentally overwhelmed himself by this posit. As Canon Law states that under fideicommissum, trusts do not exist until after the owners passing. I believe this concept of a living or revocable trust has true merit. I must expand this concept with my jurist colleagues.

Journal Entry December 1277: I, Peter of Abington, first Warden of Merton College, Oxford, shall complete the final journal entry for my dear friend and colleague, Walter de Merton, Lord Chancellor and Bishop of Rochester. The charitable trust created and massively funded by Walter de Merton, Bishop of Rochester, during his lifetime in 1264, has allowed for academics and learned students to pursue knowledge beyond just providing a roof over their heads. The concept of a trust, created during one's lifetime, whether for charity or family will offer continued plentiful opportunities for our society.

The American Story

Below is a historical fiction story of actual people and real events from the creation of the American Constitution. Their struggles and compromises led the 13 colonies controlling trust law (also how to select, remove, and appoint trustees) under their definitions and not the federal government. Below are the journal entries.

Alexander Hamilton, Journal Entry, February 15, 1787: The situation becomes untenable in Rhode Island with their debtors and we, the United States, are bankrupt. My frustration with my colleagues amongst the 12 other colonies to the north and south of my landed situation in New York demands a conversation or rather a convention. What type of power shall each state have over its citizens? The sharing of ideas will be key and ugly to unanimously agree upon. James [Madison] and his raucous Virginia bunch want their version for a stronger set of rules. I cannot believe how they want veto power for States that are deemed incompetent. I believe states should control aspects around laws and taxations. To what end though?

George Washington, Journal Entry, March 3, 1787: I cannot believe they want to me attend the Constitutional Convention in Philadelphia. I lead a rag tag army of farmers to beat George III and gain our independence from England. The plantings at Mount Vernon begin soon and need my guidance. My family demands and deserves the needs of my participation. The discord of the power separation between federal and state governments remain critical to decide upon. Recounting on my youth, father always said a farmer has more responsibility and no rest for the crops always need tending. I shall go to Philadelphia as is my duty.

James Madison, Journal Entry, May 24, 1787: Reporters shall be barred from these convention sessions. Especially those parasites from the Pennsylvania Packet run by that self promoting turnip John Dunlap. No class. Freedom of the press or speech rests on our survival but no need for bothersome drama while we figure out the future of this United States. States must control certain legal aspects of their citizens. What and how much remain unclear.

John Rutledge, Journal Entry, July 19, 1787: I am dizzy with these changes. Two weeks ago we agreed to control the power of a national government and its 3 branches (i.e. executive, legislative and judicial). I remember George III and his lack of respect to the Magna Carta principles of removing arbitrary force and will on the people. States require control over taxes, personal property rights and how those assets move between generations. Randolph gets the need for a balanced approach to federal and state power. It so hot in this city. I cannot wait to get back home to Charleston and my dearest Elizabeth.

Arthur Fenner, May 28, 1790: I cannot believe those rogues in Washington DC are calling us "Rogue Island". I took office 3 weeks ago and last week they prohibited all commercial business with our state. Fine! I will ratify that Constitution of theirs. At least I, we, the great state of Rhode Island, control our trust statutes and property laws.

Picking a Trustee in General

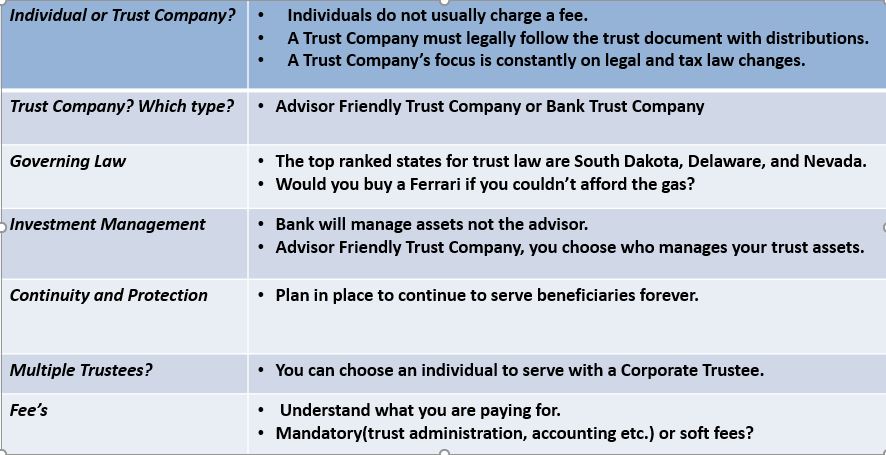

Ask yourself why do you want to establish a trust. Then, you have two options for picking a trustee — an individual person or a corporate trustee. Without a doubt, a perfect trustee answer does not exist. Instead, it depends on what you value and what you need.

Trust administration does not come easily for anyone.

Corporate trustees can 'play the notes' but can they do it with the same 'personal touch' of an individual trustee?

Here are a few big differences between an individual and a corporate trustee as trustee:

- An individual person normally does not but can charge a fee as trustee. A trust company charges a fee every time. Given these points, individual person makes a better choice based on fees.

- A person can steal trust assets. A trust company has huge checks and balances and insurance. Obviously, a corporate trustee wins this category.

- A person can play favorites with beneficiaries. To begin with, a trust company legally can not.

- A person will age and get sloppy with the trust rules. A trust company never ages.

- Trust rules, such as taxes and legal stuff, change. A person's focus is not on those changes. A trust company's focus is on those changes.

- Most people do not manage money well. Some trust companies do and some do not. After all, we do not manage the investment assets of the trust. The majority of corporate trustees do manage the investment assets of the trust. In the end, who do you want managing the trust assets - independent financial advisor or a trust company? We believe people want the flexibility and freedom of a picking who manages the investment assets of a trust such as a financial advisor.

Picking an Individual Trustee

The act of nominating an individual trustee does not have an easy Yes or No outcome. The role of an individual trustee needs to clarify one key point. Narrowing down the individual trustee role makes the decision more collaborative and natural. Two types of individual trustees exist: (1) A trustee of their own trust; and (2) a trustee over a trust with different beneficiaries. Given these points, the decision and situation of whether individual trustee should control their own trust comes down to factors listed below. When to use a friend or family member as an individual trustee hits the key points in this section.

Individual Trustee Common Traits

Imagine parents sitting around a table with their estate planning attorney. The discussions arrives at choosing the trustees of current and future funded trusts. In essence, the parents need to decide will the children be trustee of their own trust or should a family or friend act as the trustee. On balance, the parents decided that a corporate trustee does not add the extra value per the cost. The common traits of an individual trustee needs to consider the the two types.

Individual trustee of their own trust:

This decision does not rest purely on someone's GPA or IQ. The smartest of people can make the most illogical of decisions. The intent of the parents around the trust goals and how long the trust might exist set the tone. In the first place, how do the parents believe or define if their children can make wise choices on financial and personal matters. With this in mind, an individual trustee acting as the trustee of their own trust can make whatever decisions they want on distributions and investments.

This control means the trust does not protect the beneficiary if acting as the trustee from creditors or ex-spouses. The best common trait for a qualified individual trustee of their own trust means they view the trust as a supporting not enabling mechanism. Does this separation validate the intent of the trust created by the parents?

Individual trustee over a trust:

Choosing a family member or a friend to act as the trustee does not require expert knowledge on trust law. Do they want to be a trustee? They must have the humility to asks questions, not play favorites between beneficiaries, and seek help or advice when required. Trust law and duties of a trustee rests on the nuances of the law. Men with Harvard MBAs make the worst individual trustees. Whereas women, with or without college degrees, make the best individual trustees. Why? Women feel comfortable stating, "I don't know but I will seek help with someone who does." Men with great professional accomplishments have a harder time stating that to themselves. Ever heard of the guy who wont stop and ask for directions? The age of the trustee and the age of the parents must be added to the decision list.

Individual Trustee Investment Decisions

A trust can own anything. The trust creators need to decide who and how investment decisions should be made. This does mean perfect Yes or No steps. If a trust owns unique assets, real estate or businesses, the investment decisions become harder. If the trust owns stocks, bonds, mutual funds, the investment decisions become easier. Individual trustees will be held under the Prudent Investor Rule and the case of O'Neill vs. Commissioner of Internal Revenue10 reinforces this fact.

Individual trustee of their own trust:

The harder decision for parents come when the trust owns unique assets. This becomes even harder if the unique assets take real skill to manage. What happens if a trust owns an operating business with three children? Which of the 3 children acts as the trustee of the trust? Selecting that trustee creates emotional problems after the parents pass away. If the trust owns stocks and mutual funds, do the parents feel comfortable that wise decisions will be made? Some parents impose strict controls within the trust to make that outcome happen. Sometimes parents view this as the individual trustee problem and not theirs. In conclusion, make sure you ask yourselves these questions.

Family or friend as trustee:

Without a doubt a family or friend as trustee can cause big problems around investment decisions. Parents need to consider the type of controls around investment decisions. The popular decisions today for investments rest on passive or index investing. If the trust document narrows or limits investment choices this could have bad outcomes. The issue of checks and balances yield the best results. Having a family or friend as trustee making investment decisions should not exist in a vacuum. Without a doubt, this becomes critical if the trust owns unique assets. The inclusion of a trust advisor or trust protector reduces bad outcomes. To repeat, does the family or friend trustee have a history of making wise investment decisions?

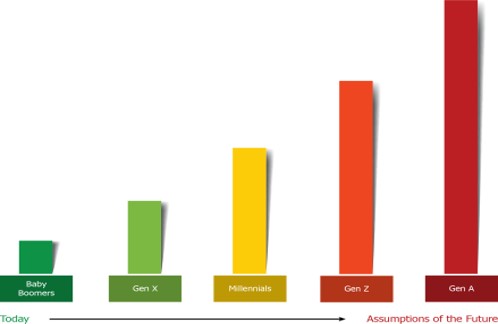

Individual Trustee Distribution Decisions

Without a doubt, trust distributions cause the greatest amount of trustee lawsuits9. Crazy, right? Trust documents outline the rules for distributions. As a result, the common descriptions of Health, Education, Maintenance and Support (ie. HEMS) do not make for easy decisions. The descriptions and reasons for maintenance and support distributions do not have clear Yes or No answers. Parents thinking about the goal(s) of the trust(s) should consider who will it serve. Imagine, parents in today considering the future of their family. Not just their children but future grandchildren, and great grandchildren. As a result, how should the intent of trust distributions provide positive and not negative outcomes. Figure 2 shows how long trust distributions could continue. Think about the social, political, financial and environmental changes coming. Trust distributions for any type of individual trustee needs to consider the now. Simultaneously, it needs to consider the uncertain future.

The individual acting as their own trustee can make any type distribution decisions. I challenge you to challenge yourself if your trust distribution decisions will lead to your children be called trust fund babies. If the purpose of the trust should serve only the current beneficiary (also the trustee) then this creates a perfect answer. All other issues held equal.

Family or friends as trustee come with bias. Some from watching the beneficiary(s) growing up. Some from the trustees own personal and professional bias. Nevertheless, the parents need crystal clear understanding and awareness of those biases. Whenever a bias exists does not always equal a bad outcome. However, not to appreciate and acknowledge a bias exists does yield bad outcomes. Choosing a trustee requires them to have an impartial approach to trust distributions. After all, if one of your children becomes an electrician, another becomes an artist, and the final child choosing a career in finance, will the trustee have a bias amongst them for trust distributions? They cannot. Specifically, some bias can be removed within the trust document. Specifically, you have the choice of controlling certain biases. Trust distributions can cause great problems. As a result, choose family and friend trustees wisely.

Individual Trustee Removal and Appointment

Nobody offers consistent and perfect decisions and actions. Notwithstanding, trust law offers the flexibility for trustee removal and appointment. In contrast, not all trust documents offer this type of flexibility and control. Often, you see appointment language without removal language. The skeptic in me believes some attorney's reside in the pocket of someone trust companies hence the removal language does not get added. Without doubt, we can assume if the removal language does not exist then the attorney exercised very bad judicial judgement.

Parents need to consider situations where the child acting as the trustee and beneficiary, cannot make wise decisions. This could occur from an accident, illness, or something else. To this end, if the trustee had a Medical and Financial Power of Attorney to plan for those events no problem exists. In fact, many people do not have those type of documents. Even more do not update them regularly. Notwithstanding, attorneys and financial advisors offer consistent and wise counsel to keep those records updated. Selecting a trustee comes down to the intent of the trust for today and tomorrow. Critically, make sure the trust document has language of whom and under what circumstances a third party can exercise removal and appointment where an individual trustee controls their own trust. Adding a trust advisor or trust protector can solve this situation as well.

Peripherally, allow beneficiaries to remove and to appoint trustees where a family or friend act as the trustee. Ensure the trust document does not require a court or judge for this removal and appointment process. On the other hand, trustee selection, when the trust gets created, does not affect this separate issue. Add additional language that the decision can occur with or without cause. Of less importance, slotting in a trust advisor or trust protector can accomplish the same goal. Just make sure the language exists to transfer a trust.

Picking a Corporate Trustee

A couple or an individual sits around a table or worse discussing over the phone their estate plan. Who gets what, where, when and why. A flood of emotions swells around them. As a result, they think about kids, grand kids, nieces, nephews, friends, and charities. Each pull on the couple/individual's emotion and intellectual bandwidth. The time comes to decide who will make those what, where, when and why decisions. A friend or family member or a stranger, the bedeviled corporate trustee?

"A goal without a plan is just a wish"

Antoine de Sainte Exupery

The traditional trustee model has existed for close to 700 years. The staid bank trust company model has been around for 500 years. What I call 'The Age of Enlightenment' in the trustee or trust fund industry started around the 1980's. At some point, people, like you and me, want control and choice. Figure 3 shows three current corporate trustee models.

The Red Model outlines an example of what a traditional bank trust company offers. Importantly, their trustee services should not automatically fall under bad. For certain situations their solution falls under the perfect answer. The Green Model describes directed trusts. Selecting a trustee under this model provides lots of control and choice around investments and distributions. The Blue Model provides a hybrid where the corporate trustee deals with trust distributions but delegates the investment decisions to a third party. Among financial advisors the Blue Model and Green Models are best known as an advisor friendly trust company solution. Picking a trustee for clients under the Green and Blue Models also provides control and choice.

Corporate Trustee Common Traits

The different definitions of corporate trustees can be found the at top of this blog. As a result, it does not warrant your precious time to repeat the same information here. The first common trait of a corporate trustee - they exist to exist forever. The employees come and go but the corporate trustee lives forever. Your first question of picking a trustee - does their company DNA match your DNA? Questions to any corporate trustee rest on the why not the what [note: all 17:49 minutes are worth watching]:

- Why do you exist serving clients?

- In what areas do you believe consistently need improvement?

- Where does the company inspiration come from to keep adapting?

- Why do you not serve certain types of clients?

- Give me examples of how your collaborative trustee distribution decisions?

A corporate trustee owns the trust assets. Chiefly, what type of control, investment and distributions, do you want to give them? Why? Why not? Always remember, employees come and go but a corporate trustee's DNA remains the same forever. Critically, picking a trustee should not be made casually.

Corporate Trustee Investment Decisions

A trust can 'hold' or own anything. Let's work together on a case that exists thousands of times in America in how picking a trustee would work:

Facts:

- Betsy and Bill Frank, in their 70's, currently own $15 million in operating assets (i.e. operating businesses, entities, real estate etc.) and $10 million in marketable securities (e.g. stocks, bonds, mutual funds, ETFs).

- The operating assets have the potential to thrive and to survive after the passing of Betsy and Bill.

- The grown children names: Audry and George

- Estate attorney: Chuck

- Wealth manager/financial planner/financial advisor: Robert

- Audry has the skills and experience to run the operating businesses. George does not.

A bank trust company acting as a trustee for the marketable securities poses no problem. Most importantly, whether they will manage the assets well, and what well means, can be decided by Robert and the Frank's. To that end, using an independent trust company makes the choice easier. Robert and not the trustee will make the investment choices. Audry and George can remove the advisor at any time. Easy. The hard part now comes on the operating assets. We can all admit no corporate trustee will manage the operating assets with the same plum and success as Audry or the Franks [note: Sorry Robert but you are not being considered].

The Frank's choosing a bank trust company to control or to make investment decisions on the operating assets will become a disaster. Corporate trustees do not want to get sued. Indeed, managing operating assets is really hard. Managing those assets worrying how not to get sued will not work. The Frank's have two options: (1) Place the assets inside a Manager Managed LLC under a directed trust layout in a top ranked trust state [note: trustee cannot elect, appoint or remove Manager] using a Trust Protector for certain powers; or (2) Sell the operating assets prior to or right after the Franks passing.

When picking a trustee consider what the trust will own, the amount of confidence the family has in the investment decisions of the trustee and how to streamline the trust administration rules [note: streamlined trust administration means lower trustee fees]. Peripherally, many estate planning attorneys forget this sometimes when drafting trust agreements.

Corporate Trustee Distribution Decisions

A trust's key role rests on making distributions to beneficiaries. Sounds very simple. To sum up, trust distributions can be simply separated between: (1) Discretionary and/or (2) Automatic. Discretionary means the trustee decides whether to approve the distribution. Automatic means the trustee does not have to make decisions as the amounts, timelines etc are clearly laid out in the trust document.

Nevertheless, trustees do not want to get sued. Complications continue to pile up on trust distribution decisions due to vague or conflicting language in the trust document. Picking a trustee needs to consider how mindful they are on trust distributions. The standard trust distribution language of - Health, Education, Maintenance and Support (e.g. HEMS). In fact, we all agree on health and education definition. Corporate trustees freak out on making maintenance (aka want) and support (aka need) trust distribution decisions. Individual trustees on other trusts do not freak out because they have no idea or experience on the legal liability around bad decisions. Here is a sample concept sentence to remove doubt and delay:

"The trustee shall consider trust distributions around the beneficiary(s) needs of health, education, maintenance and support and shall consider the beneficiary(s) other sources of income or their current lifestyle when making discretionary distributions."

The bolded words are really really important. As a result, they provide the intent of the grantor (e.g. creator of the trust) around trust distributions. I beg you to read the distribution sections of your Wills and Trusts very very carefully. Whenever trust administration rolls on a streamlined basis the trustee fee declines. To this end, trustees can be sued for making or not making distributions11. Bottom line: Corporate trustees that are careful which clients they accept, do not over promise and do not overload trust officers with trust accounts will make great trust distribution decisions. To figure out these answers go to the common traits of a corporate trustee section above.

Corporate Trustee Removal and Appointment

The trust language MUST allow for a corporate trustee removal and appointment by a beneficiary(s) [note: never unanimous, just majority] WITH or WITHOUT cause and not needing the involvement of a court of judge. This gives everyone the ability to pick a trustee without the entrenchment of making that decision difficult. In conclusion, I am going to go out on a limb here because I know I am morally correct:

"Any estate attorney that only includes language for the resignation of a corporate trustee and not the easy removal and appointment of a corporate trustee should be mightily ashamed of themselves.

Consequently, if any organization knows the hurdle and/or hassle factor for their removal remains high what drives them to do better everyday? Enough said.

Trust Protector and Trust Advisor Roles

Sometimes there exists a simple way to get the best from a corporate trustee with the personal touch of an individual trustee. Over the last twenty years the roles of trust protector and trust advisor have come into vogue. The critical decisions rests on whether the trust protector or trust advisor have fiduciary decision making ability or just a passive, suggestive role. Adding these roles into a testamentary trust (created within a will) or a revocable/irrevocable trust should following the same steps in picking a trustee. The definitions of these roles outlined in this blog do not do justice on their power and importance and importance in making the picking a trustee easier and collaborative.

Trust Protector Outline and Issues

Trust protector powers rest on the state trust statutes and what the trust document outlines. The intent of the trust protector should be to work collaboratively with the corporate trustee. The trust document should clearly describe the roles and powers of the trust protector and the specific areas where they share or have all of the fiduciary risk. Sharing fiduciary risk with the trustee creates havoc. Please avoid. Here are some powers of a trust protector:

- Power to change the situs (ie. location) of the trust

- Authority to move the governing law of the trust (important for someone to have including the trustee)

- Decision to terminate the trust under certain conditions (trustees can have this power as well)

- Capacity to amend the trust for valid purposes (trustees can have this power as well)

- Function to remove and to appoint corporate trustees

When considering the role and power of a trust protector consider the trust may last 100 or 200 years. Society will be different. Moreover, consider the intentions of the trust creator. Secondly, make sure there is a clear and consistent process for the trust protector succession (includes removal and appointment).

Trust Advisor Outline and Issues

A trust advisor falls under a less defined term. Besides, if they are providing guidance on trust distributions then the grantor's intent is clear. The same issues described above regarding the trust protector should be considered for the trust advisor.

Picking A Trustee - Bringing It All Together For You

Picking a trustee means making many assumptions about the future. In addition, giving checklists and the pros and cons of an individual trustee versus a corporate trustee makes choosing a trustee easier. In brief, you get to decide which is best for you. That decision leads to cost-efficient trustee fees.

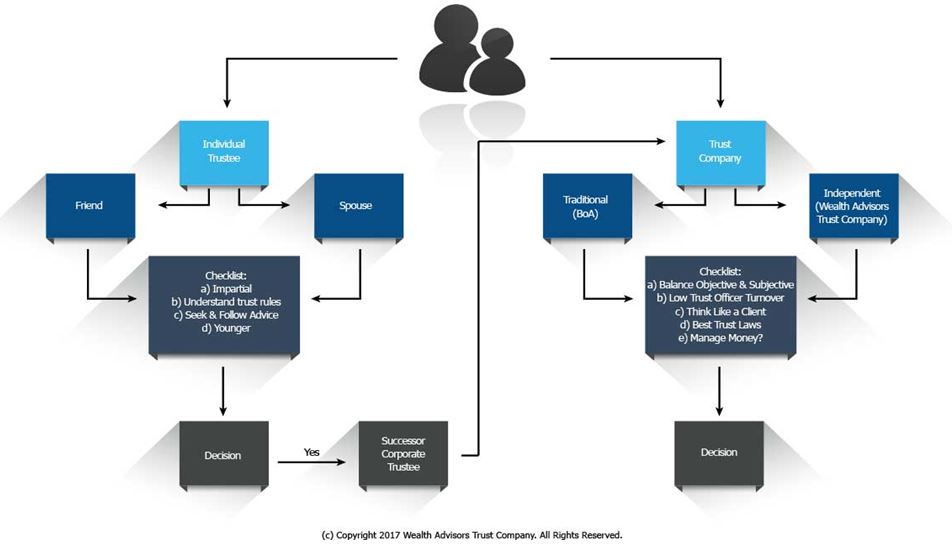

Picking a trustee should reflect your goals and wishes. Figure 4 provides an easy flowchart. Furthermore, the matrix below provides questions around each step of the flow chart.

The goal of this blog was to make picking a trustee easier. During and after reading and thinking about the content, the process should become less stressful and more mindful than choosing toothpaste at the grocery store.

End Notes

[1] F.W. Maitland, Harvard Law Review, Volume 8, No. 3, October 25, 1894

[2] Id.

[3] Luigi Capogrossi Colognesi, Ownership and Power in Roman Law, October 2016

[4] Gilbert Paul Verbit, The Origins of the Trust, September 9, 2002

[5] Matthew Brunson, Encyclopedia of Roman Empire, p. 300, Infobase Publishing, May 14, 2014

[6] Alan Weston, The Digest of Julian, Vol. 4, Book 36, p.226, University of Pennsylvania, June 24, 2011

[7] Edmund Hobhouse, Sketch of the Life of Walter de Merton, p.1, 1859

[8] Edmund Hobhouse, Sketch of the Life of Walter de Merton, p. 4, 1859

[9] Id

[10] Herald A. O'Neill and G. Evelyn O'Neill vs. Commissioner of Internal Revenue, No. 16039, United States Court of Appeals Ninth Circuit, October 1959

[11] Doherty v. JPMorgan Chase Bank, N.A., No. 01-08-00682-CV, 2010 Tex. App. LEXIS 2185, 2010 WL 1053053