This blog post addresses two audiences on estate planning for millennials: (1) financial advisors; and (2) millennials themselves. The information came from an August 2020 presentation Wealth Advisors Trust Company gave uber-successful Millennials wanting to learn the ABCs of estate planning in 15 minutes. Advisors will learn how to serve/prospect to millennials with a broader scope and understanding. Millennials will learn how to think thru the philosophical complexities of estate planning around their wealth and family. This post will include:

An essential estate planning checklist should be offered to any type of client. The uniqueness around those checklists rests on the age, wealth, and surrounding family/business circumstances. Uber-successful millennials exhibit the same stressors as previous generations. The benefits millennials can access - information and knowledge - such as reading this blog or anything related to the internet. The drawback millennials must confront around estate planning worksheets or plans that previous generations could avoid - not confusing information and knowledge with wisdom. Previous generations could access information or knowledge easily. Time and effort were a requirement. The trifecta of information, knowledge, and understanding will have a steeper learning curve for millennials and future generations than past ones.

To know the right questions to ask and when allows for answers to follow in an easy order. Advisors seeing the most considerable client successes around estate planning for millennials or any other type follow an inverted triangle process. If you know the rights questions, the right answers follow quickly in line for estate planning basics or any different financial planning/wealth management topic.

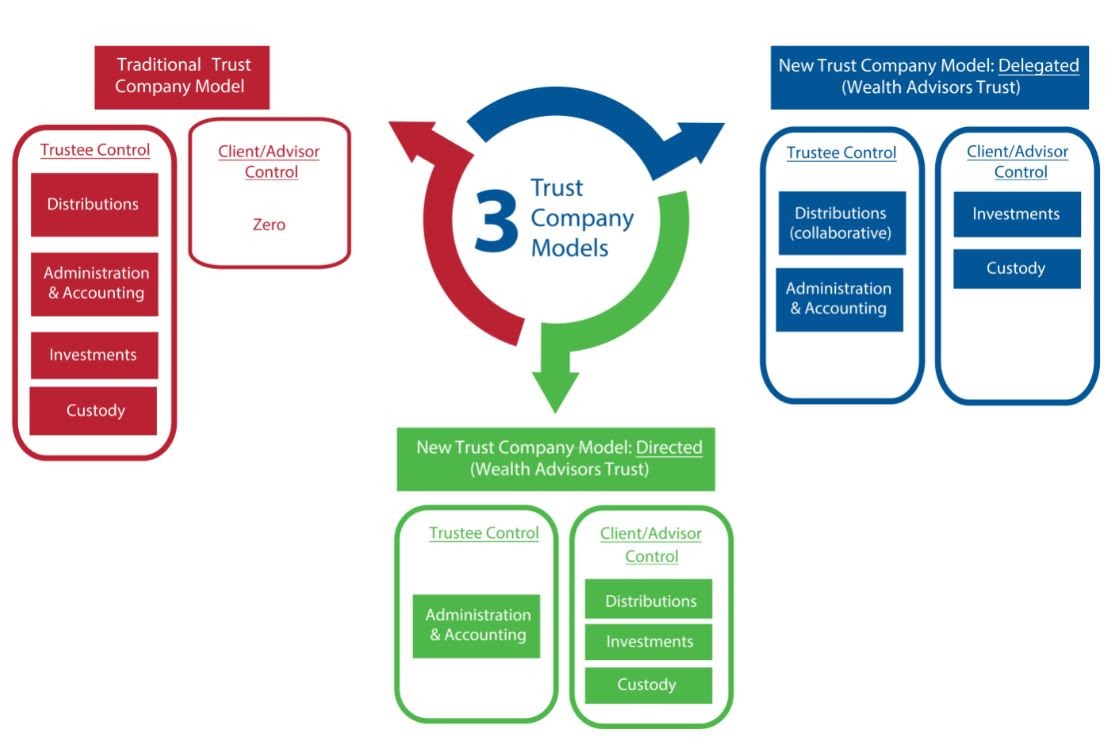

Creating an estate plan starts with a Will and could lead other various trust types. The process begins with broad and philosophical questions. Estate attorneys can do this work, and some are very good at it. The pickle issue becomes how an advisor/millennial knows which estate attorneys are form fillers or, great thinkers, within a pre-subscribed budget. Advisors’ compensation structure allows them time to think broadly and carefully around estate planning concepts and considerations based on philosophical issues and not the rule of law issues.

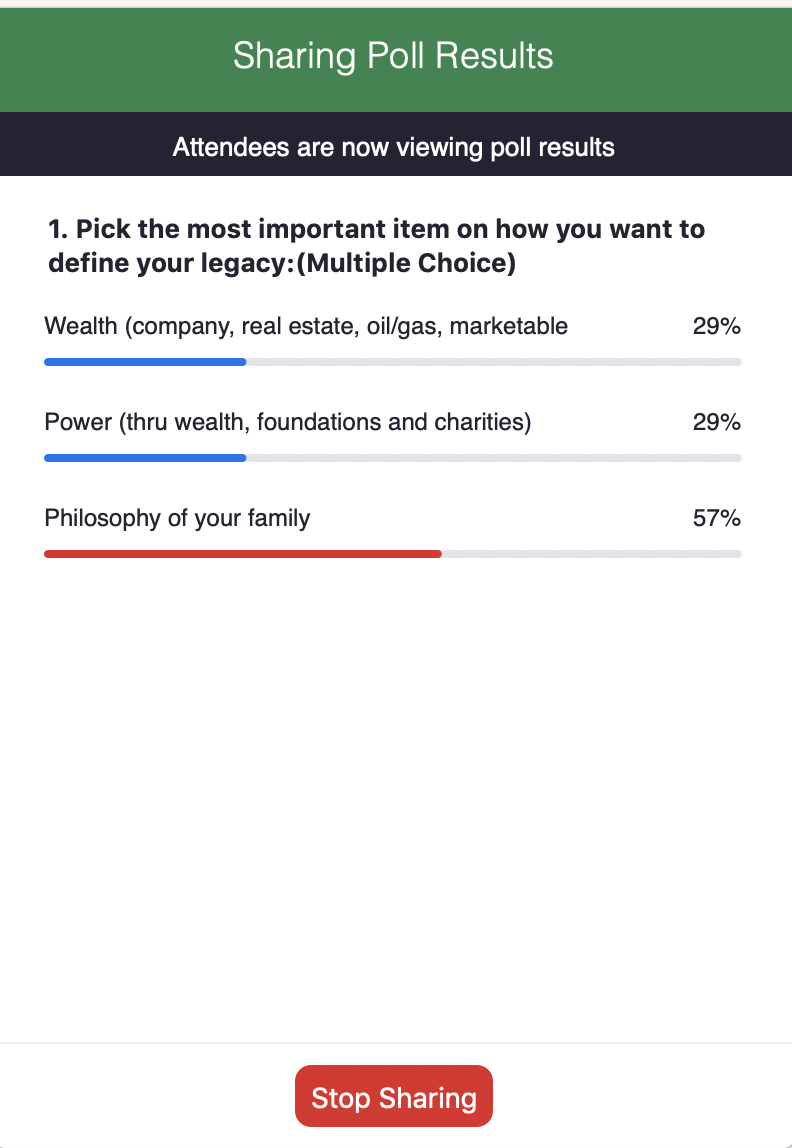

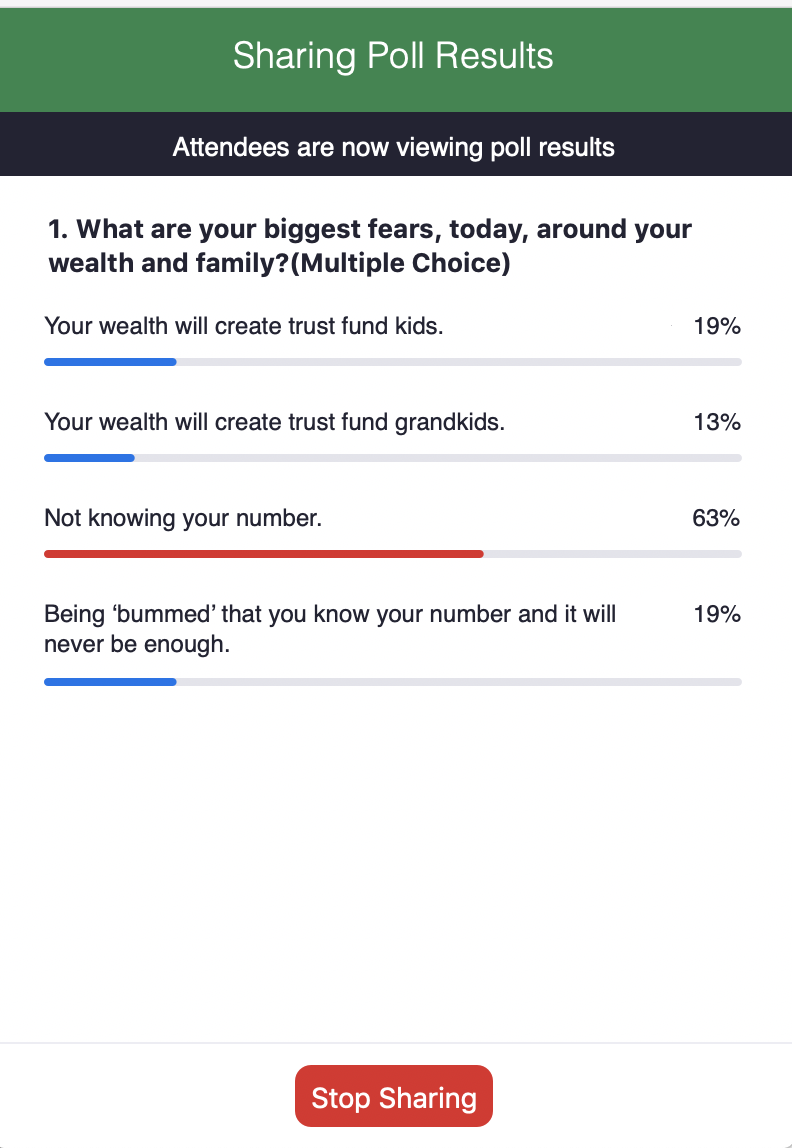

Below are the results of a poll taken during the presentation given to uber-successful millennials around estate planning.

The poll results above were taken during the discussion around these initial questions. Here is the list of initial questions to ask millennials about estate planning issues. To get the ball rolling:

Estate planning attorneys want to provide a smooth and natural process for their clients. Financial planners assisting clients with the estate planning process need to understand the attorneys’ perspective. The law is driven by logic and case law. Attorneys must put actions, dreams, tax plans, etc. all within written language without creating more confusion. Like working with a doctor, knowing the broad questions will help elicit better answers from the attorney and/or financial advisors. Millennials must understand that a Will and potentially other estate planning documents such as Irrevocable Life Insurance Trusts, Grantor Trusts, Charitable Trusts, etc. are not a form. As shown above, the questions are critical. Legal Zoom is garbage.

You should not expect more from your morning coffee than your legal estate planning documents.

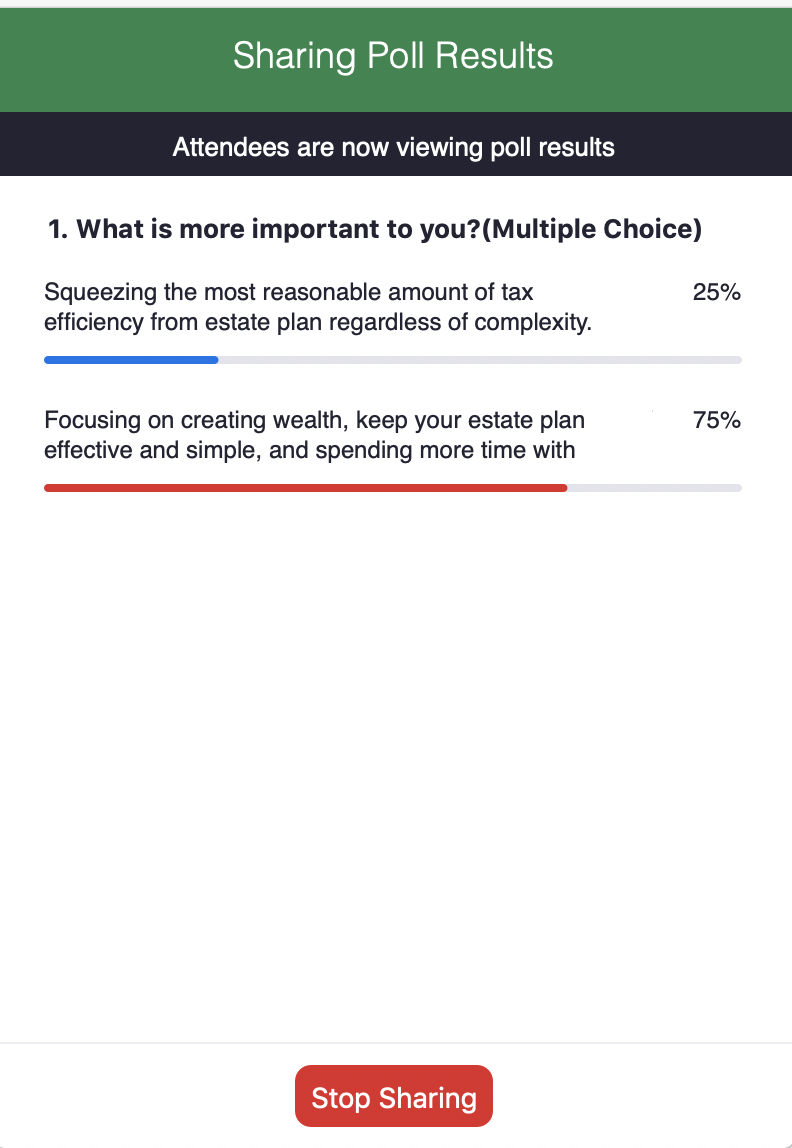

These poll results above were asked during the section around questions to ask your estate planning attorney. Here is the list of those questions:

Sometimes estate planning is an ongoing process. These uber-successful millennials know that there will be at least two significant estate planning moments and multiple updates—just standard stuff. Many estate planning aspects deal with minor issues.

Three big issues to consider:

Two side issues to address:

Disclaimer: None of these observations, comments, or opinions should be considered legal or tax advice. Please consult with a licensed attorney on trust and estate planning projects.